The U.S. workforce is still plagued with uncertainty as the pandemic ebbs and flows and expanded benefits are set to expire in September 2021 for many U.S. states.

At ManpowerGroup, we ground our point of view from our experience in connecting hundreds of thousands of people to work each year and advanced data that provides actionable insights that allow us to best guide employers through these uncertain times.

Employers today are asking if wages will continue to rise in September 2021, and whether they will see a surge in job candidates who are willing and able to work, making it easier to fill roles.

Will wages continue to rise?

Let’s start with the current situation. The economic recovery is happening faster than anticipated, but workers are taking longer to return to the labor market. Job openings reached 10.1 million in June, but the labor participation rate for July was 61.7%, lower than any year in the last 20+ years. There are multiple reasons for this. Part of the problem is a discrepancy between where openings are and what parts of the economy were hit the hardest. For example, service jobs are at a greater deficit than other industries.

The economic recovery is happening faster than anticipated, but workers are taking a longer time to return to the labor market.

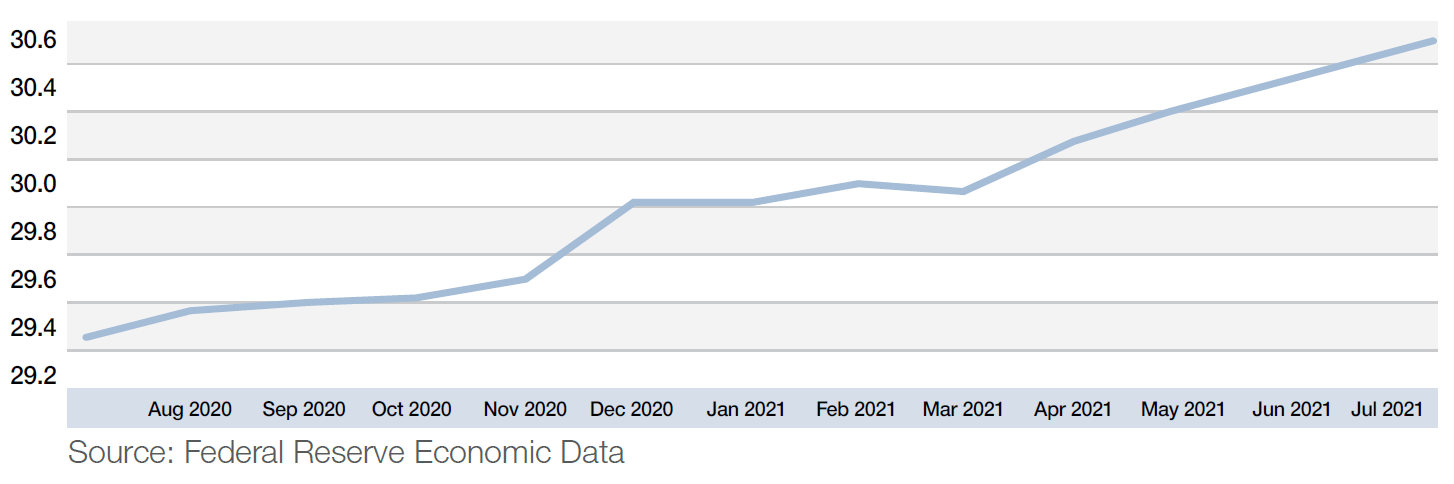

- Wage growth in the U.S. has been incredibly slow over the past 30 years. The federal minimum wage today sits at $7.25 per hour; in 1961 it was $1.15 which would be the equivalent of $9.88 per hour today.

- However, in 2020-2021, wage growth accelerated at such a rapid pace – especially in blue-collar and manual work – that it resulted in gains we would expect to see over the course of a decade. Average wages grew by 4.0% from July 2020 to July 2021, much faster than what we would have expected to see pre-pandemic.

- Major companies have raised their minimum wage to gain an advantage in the marketplace – Amazon, Costco, and Target are raising their minimum hourly wages to $15. In some cases, they’re advertising starting pay of $18 or higher. Jobs that pay at or close to the current federal minimum wage are increasingly difficult to fill.

- Since the pandemic began, blue collar workers have received an average 6-18% increase in take-home pay.

Based on the data, we expect wages will continue to increase as we anticipate demand to continue to outpace supply. Of course there will be variability by geographic location, industry and job type, however we are seeing larger companies setting the pace in a way that is moving the market – and this will require organizations of all sizes to be increasingly nimble in their attraction and retention strategies.

Will I be able to fill my open roles?

First, let’s look back to 2020 for guidance.

- Covid-19 case surge history: Many are wondering what the relationship was between past surges and hiring patterns and what that tells us about how we forecast going forward. Covid-19 surges happened at different times and in different parts of the country in 2020. While job opening rates across the country remained relatively steady month-over-month, hires roughly mirrored Covid’s geographical surges: in the Northeast (hardest hit in the first surge) hires were weakest in the spring and rose through the summer. In the South and West, hires fell slightly as the virus surged in July and August, and in the Midwest, hires fell off in the fall as Covid gained momentum.* Although we are seeing a surge in cases since July 2021, we expect increasing vaccination rates will help temper a peak in cases and impact on the workforce at the level we saw in Fall 2020 when vaccines were not yet available.

- The school factor: What happened last September when kids went back to school? The Census Bureau reports that 93% of school age children reported some form of distance learning in 2020. Many children started this pattern in the spring, however, so there was no associated rise in unemployment in September. And historically, there has been no associated nationwide flurry of job seekers returning to work at this time.

It’s not likely that we will see an immediate flood of job candidates in September 2021 once many expanded benefits end, but rather a trickle that may increase over the following several months.

What else is motivating/demotivating today’s workers?

Unemployment Benefits: Many have suggested that extended unemployment benefits and the $300/week supplement have made people less likely to return to the workforce. Our July 2021 Talent Pulse reported that 1.8 million of the 14.1 million Americans receiving unemployment benefits had turned down jobs because of enhanced unemployment insurance benefits.

However, in the 12 states that have already ended these benefits, the share of adults with jobs actually fell by 1.4 percentage points in these states according to CNBC and data from the Census Bureau.

Manpower’s own data paints a similar picture: between the states that cancelled and states that have maintained the $300 supplement, there has been no notable change in the number of job advertisement responders and the number of candidates who engaged in an interview.

We are finding that today’s job candidates are seriously considering other important factors when choosing when and where to work.

What’s my best strategy?

Here are some key ways you can position your company as a choice employer in order to compete for top talent while we remain in a talent-scarce market.

- Be wage competitive. We expect wages will continue to rise in this candidate-driven market. Consider raising yours. With a limited supply of qualified workers, we expect the supply of jobs will continue to outpace the supply of workers, adding to increased wage expectations. Just as important, don’t forget about your current staff. Consider raising wages 6-18% for current workers or offering retention bonuses. Our estimates show that it costs roughly 25% more to hire than to retain your current staff.

- Embrace flexibility. Workers are embracing One Life – a balance of work and home life. Although wages are a critical deciding factor, don’t overlook the value of offering a flexible work environment to attract and retain talent. That includes more time off and a remote or hybrid work schedule if feasible. Whatever you decide to do, make your policy crystal clear.

- Speed up onboarding. As of mid-July, Manpower tallied a 16%-24% no show rate. This is likely because in such a job-rich climate, candidates do not want or need to accept a lengthy hiring process. Do whatever you can to shorten the decision making process by eliminating burdensome compliance requirements. Consider eliminating background checks or drug screenings, switch to oral vs. lab-based screenings, or conduct testing while the employee is already on the job.

- Cast a wider net. Look for transferable skills. For example, a candidate with retail sales experience may have the right transferable skills in customer service to work in a call center. Also lower minimum hiring standards, consider rehires, and specify skillset/ resume must-haves versus “nice-to-haves”.

- Lead with Health and Safety protocols. Have clear mask/vaccination guidelines (knowing that local regulations may change). It’s important to have a written and enforceable policy that includes positions on vaccinations, mask wearing, and communication.

Be sure to also communicate all of the added measures you are taking to help keep staff safe. In an online survey of nearly 1,800 U.S. workers conducted in August 2021, ManpowerGroup learned that cleanliness remains a key motivator for workers, as well, with 68% of respondents reporting they would be most comfortable working for an employer that demonstrates extra attention to a clean work environment. Another finding that could impact your approach is that of a subgroup of 1,245 survey respondents with an estimated average hourly wage of $15, vaccination rates fall 25% lower than the national vaccination rate for U.S. adults (46% vs. 62%) indicating that vaccination rates could vary widely based on take-home pay.

Attracting and retaining the best talent today boils down to what you can offer workers. But first, you need to know where you stand amongst your competitors with regard to your ability to attract and retain talent. With this knowledge, you’ll be able to pull the levers that could impact your workforce.

Comments